The only change to my portfolio this month is that I purchase another 23 lots of AIMSAMPIREIT at $0.215 2 days ago to round it up nicely to 120 lots. Apart from that, I didn't see anything good for buying for myself. I'm getting more and more cautious at the moment, only entering very selectively. There's a time to buy, there's a time to wait, and there's a time to sell. To me, I believe this is the time to wait, to be excessively patient and cautious. While I believe markets can still rise, most stocks at this level have a low margin of safety as compared to before, so I would wait.

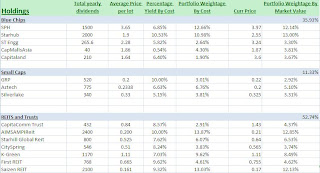

A short summary of my core holdings:

Portfolio cost: $173k

Portfolio value: $196k

Percentage gain: 13.37%

Dividends reached $1155/mth on average. No dividends this month, but I'm expecting dividends to come (starting from 28th Feb) from Starhill Global REIT, CapCommTrust, AIMSAMPIREIT, KGT, CitySpring and First REIT. I'm also expecting dividends to come from GRP and Saizen after they announce their results. Starhub's yet-to-be-announced dividends would most likely be delayed, typically coming after their AGM.

My percentage gain rose mainly because of First REIT's rebound. A number of holdings went XD this month as well, namely AIMSAMPIREIT, CapCommTrust, and First REIT.

Adding to the $24k in the basket I hope to sell off at the bottom, my total cost stands at $197k, an increase from the previous month's $192k. Adding these to my MMF units, my total available funds for investments stay constant at $205k. I did not pump any new money into my MMF this month.

Trading Basket -- Hoping to sell off

I want to sell these off when I can, or cut loss when I can take the loss :(

Portfolio cost: $24.3k

Portfolio value: $18.5k

Unrealised loss of around $5.7k

(red = freezer stocks to remind myself of my mistakes)

30 lots of Hor Kew at 0.125

27 lots of LC Dev at 0.177 (accepted the rights + 3 lots excess)

2 lots of Cosco at 2.67

160 lots of Berlian Laju at 0.065

Hi DW,

ReplyDeleteI am oso looking at AIMSAMPIREIT too. But the previous fiasco wif Cambridge really made me hesitate numerous.

Now, I am really tempted to go in at $0.210

The annual yield is about 9% right?

Hi JW,

ReplyDeleteAgree with you, caution and patient is the game now.

Looking to top up AIMSAMPIREIT too. Q a few times @ .21 but didn't get. :)

Hi DW,

ReplyDeletethe fiasco actually made me not want to put my monies with Cambridge.

Annual yield is about there, yup.

Hi Sanye, I believe it would be tough to get at 0.21, hence I jumped queue at 0.215 while the CD didn't appear yet.

ReplyDeleteSo my average is around 0.21 after XD.

Hi JW

ReplyDeleteI saw that you have bought silverlake axis too. What is your view on this stock? I bought it at 0.345 and it is motionless in the beginning and now it begin to roll down. Should you think tat I should sell it or hold it? What is the TP you expecting Thanks.

Hi Anonymous,

ReplyDeleteMy views are here. I bought it at 0.33.

http://wealthbuch.blogspot.com/search/label/Silverlake%20Axis

I have no time to truly review the latest results yet. :(